Explore a variety of complimentary documents and templates that are designed to support you on every step of your financial journey. These resources are available to help you make informed decisions, streamline your processes, and effectively manage your financial goals.

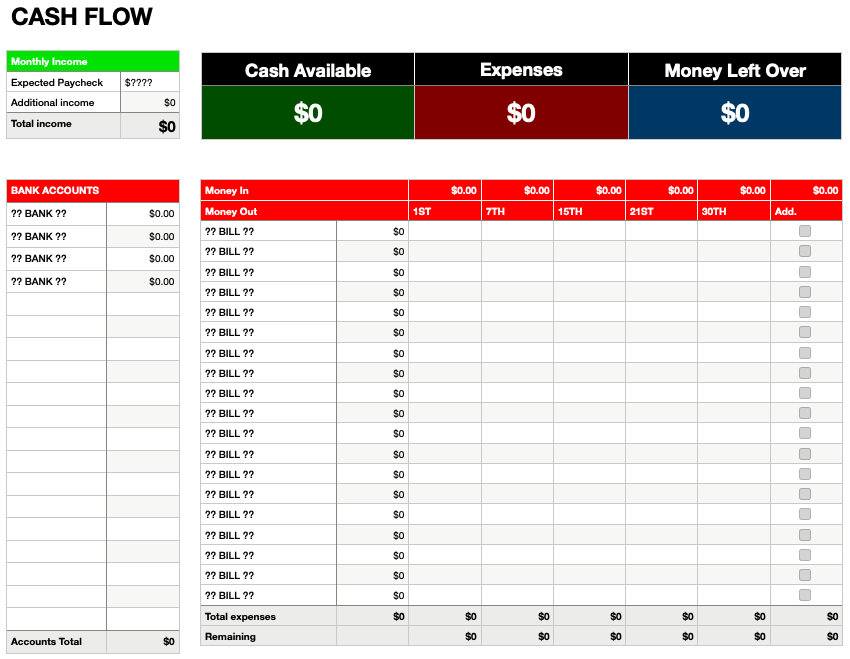

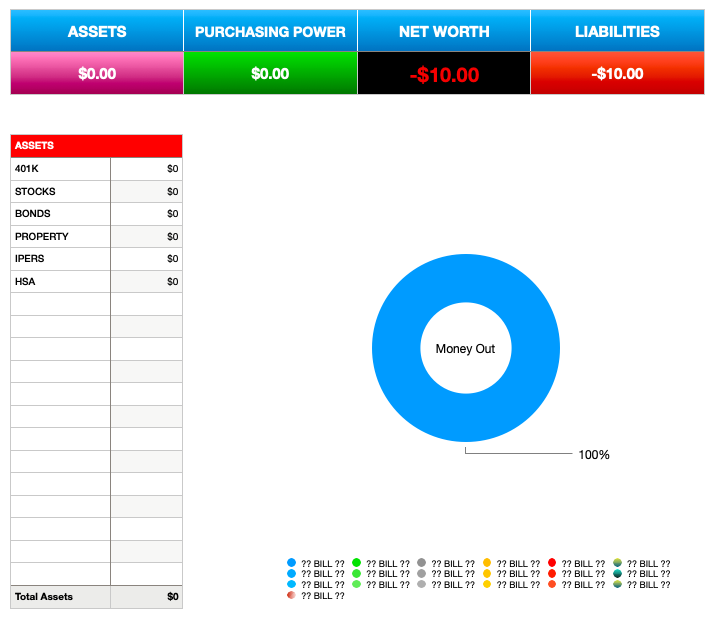

This budget template provides a comprehensive, all-in-one financial overview designed to help users manage their personal finances with clarity. At the top left, the cash flow section summarizes key metrics such as available cash, expenses, and the remaining balance after bills. It includes space to list expected paychecks, additional income, and a detailed bank account tracker. The “Money Out” section allows users to log recurring bills and their due dates, making it easy to see upcoming obligations. In the center, a net worth summary breaks down total assets, liabilities, purchasing power, and overall net worth, supported visually by a donut chart that displays how money is being spent. The assets panel lets users list items like 401k accounts, stocks, property, and savings. On the right, the debt and credit section tracks outstanding credit balances, loans, collections, and money owed to individuals or companies, with designated columns for balances and lenders. At the bottom, the “Banks Spending and Transactions” section offers space to log daily expenses and income across multiple bank accounts, with columns for date, description, category, and totals for spending. This color-coded and neatly structured layout is ideal for users looking to organize income, control spending, monitor debt, and maintain a clear picture of their overall financial health.

Basic Cash Flow Template (Numbers App) 295.09 KB

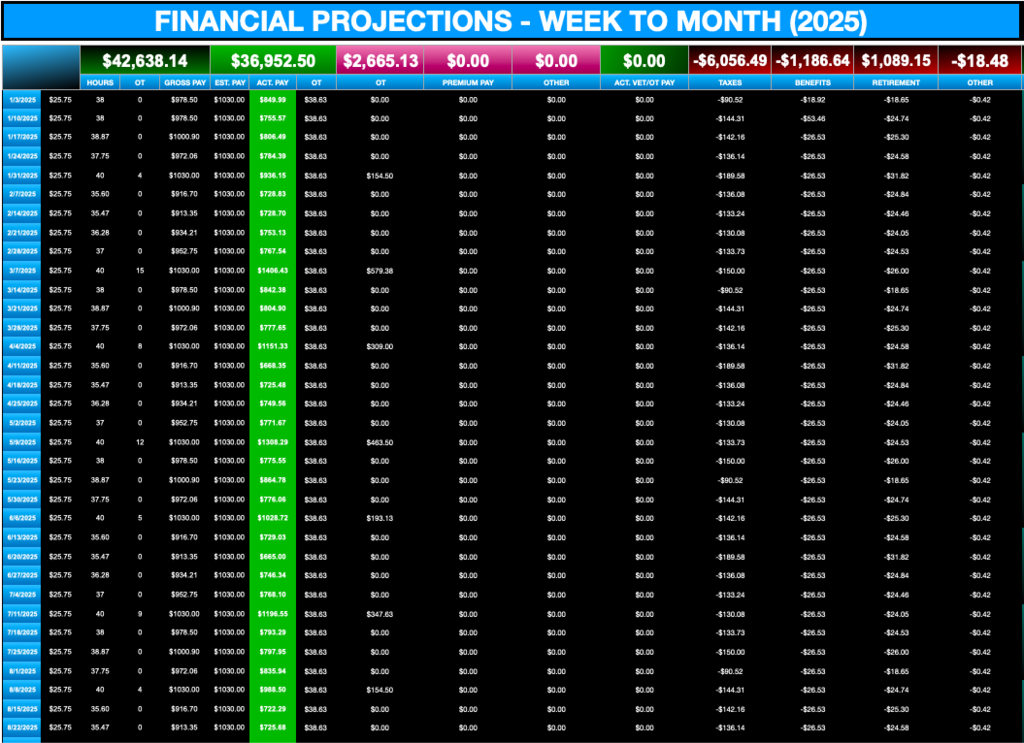

This advanced budget template provides a detailed financial planning system for tracking income, deductions, expenses, and cash flow for the Year. The “Financial Projections – Week to Month” section breaks down weekly paychecks with details on hourly rates, hours worked, deductions, and real-time calculations of net pay. Summary boxes display cumulative amounts using color coding to differentiate between income and expenses.

The “Financial Overview – Money Movement Projections” section offers a monthly view of financial performance, detailing income, expenses, and remaining funds. It tracks fund allocation across accounts and summarizes key figures for easy reference, aiding in cash flow visualization and savings planning. This template is ideal for managing financial goals and maintaining long-term budgeting health.

This advanced financial dashboard is a visually-driven system for managing personal finances year-round. The top left corner features a summary of key categories like income, expenses, savings, loans, and investments, with year-to-date totals, account data, and color-coded cash flow indicators. A pie chart and monthly bar chart display income trends, and a vertical cash flow meter shows real-time fund availability.

To the right, a net worth and debt tracking section uses bar graphs to illustrate liabilities versus assets. A bills tracker logs recurring payments and due dates, ensuring timely bill management.

The center provides a month-by-month budget performance analysis with color-coded tables comparing income, spending, savings, and investments against goals. An expense log tracks individual transactions, while a table monitors bill payment statuses.

At the bottom, account tracking and budget allocations are highlighted. Tables show contributions to checking, savings, and progress toward goals, categorized into needs, wants, debt repayments, and investments. A transaction log offers a chronological view of financial activity.